The Central Bureau of Direct Taxes (CDBT) today in a surprise circular said that those having income below Rs.5,00,000.00 will also have to file returns for the Financial year 2012-13 for the year ending 31.03.2013. The article appeared in Times of India, Mumbai edition today which you can read here. This is a very surprise move because for the earlier two AYs 2011-12 and AY 2012-13, the Income Tax department had exempted those who were earning less then Rs.5.00 lakhs from filing any returns. However with just 8 days remaining for the deadline, Income Tax department is expected to extend the deadline in lieu of rush on the above order.

I have already give a tutorial for e-filing Income Tax returns offline which you can refer to here.Today I am giving a tutorial for step by step guide for e-Filing the Income Tax Returns for A.Y. 2013-14 online. This method is easier then the offline method and can be used if you are salaried employee. Do remember to keep your PAN Card Number, Form 16 and Bank A/C details ready for proceeding with it.

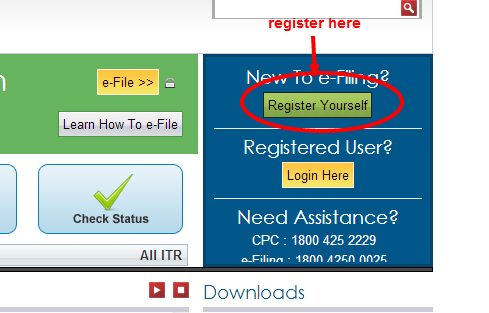

1. Go to the Income Tax departments e-filing site here. Register yourself as per below pic. Remember to give a proper password.

In the registration Page give your status as individual as below

Press Continue and this will bring you to another window. This is a important window. You should fill in your correct PAN (Permanent Account Number), your name, Mobile phone No. email id as illustrated below :

Follow the steps in the Registration form page two and three and after successful registration, you will get a email in your inbox. You have to open this email and activate the user name (PAN number)

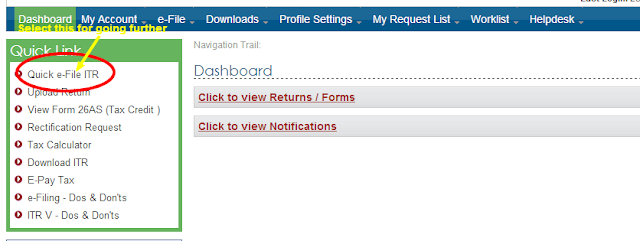

Once activated you head back here. Login using the PAN number date of birth in 01/01/2011 format and the password you had given at the time of registration. Once you have successfully entered the above details you will be led to this page. In this page select the Quick e-File ITR as given below to proceed further

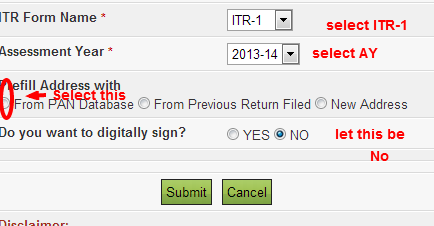

In the next window you will be asked to fill in the ITR No. Select ITR 1 from the drop down box and AY 2013-14 from the next drop down menu. Select From PAN Database (This is important)

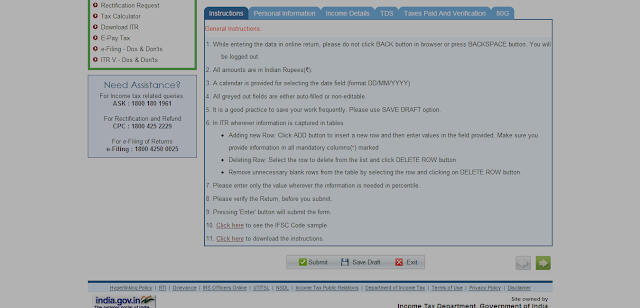

From here you will be led to this page.

You can see that it has six fields at the top and submit, save draft and exit at the bottom.

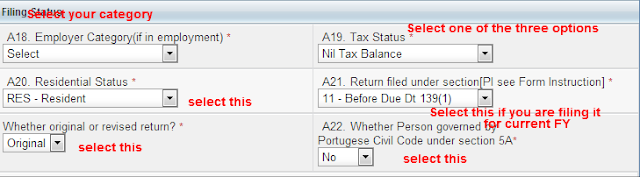

Keep on pressing SAVE DRAFT every 5 minutes as if you don't you will have to login again and complete the process again(the website also reminds you that). In the next field i.e. PERSONAL INFORMATION fill in the personal details carefully. In the filing Status field use the illustration below

Press Save Draft and proceed to INCOME DETAILS field. Enter your income details in this Page and the deductions under Chapter VI A as given in your Form 16.

In the Taxes Paid and Verification, the taxes if already deducted will appear automatically. Refunds due if any will also show up in this field. In the Bank details field on this page fill in the proper bank details including the IFSC code. You can check the IFSC code from your Chequebook, Pass book or here(this is a lengthy process) The IFSC code is a 11 letter code which always starts with the bank name for example State Bank of India code always starts with SBIN.

Once you have filled the details correctly press the submit button at the bottom of your page. The website will ask you to confirm whether the details are correct. Press yes and there it is done!

The page will show you ITR V which can be downloaded. You will also receive a copy of the ITR V in the email id you have given on the Personal Information page(not in your registration id).

Your ITR-V/ Acknowledgment is protected by a password for your security. Please enter your PAN (in small letters) and Date of Birth or Incorporation (in ddmmyyyy format), in combination, to view your ITR-V/Acknowledgment. If your pan is AAAPA0000A and the date of birth is 10-Jan-2008, then the password will be aaapa0000a10012008.

Remember to send it by Speed Post/Ordinary Post only Courier is not allowed.

Address :

Income Tax Department - Centralized Processing Centre,Post Bag No - 1,Electronic City Post Office,Bangalore - 560100,Karnataka - India.

If you have any problems with the above kindly comment on it and I will try to solve your problem. If you have successfully filed your e-Return with my tutorial, kindly post in your comments also.

This is a far easier method but requires little patience and diligence. Remember by paying your taxes and filing your returns, you not only take part in nation building but you also save your valuable time and resources.

No comments:

Post a Comment